Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

Physical Address

304 North Cardinal St.

Dorchester Center, MA 02124

As Americans, we have become accustomed to crisis. Crisis has become the operative terminology for capturing the turmoil that has rudely intruded itself into the lives of many of our societal members. The results of this intrusion are long-term unemployment, record number of home foreclosures, and profound feelings of helplessness and loss of self worth. However, upon close examination, this crisis is unusual because despite the fact that experts have labeled it a financial crisis, beginning in 2007, several large corporations had recorded record profits during the period from 2008 to 2011. While corporate America’s financial bottom line has stabilized and in several cases achieved record growth levels, the budgets of local, state, and federal governments are experiencing long-term deficits. Moreover, record number of Americans have lost or are losing their homes, savings, and confidence in the future. This loss of confidence is accompanied by the growth in inequality and escalating attacks on the American middle and lower classes by the state and the private sectors. Given these developments, this article seeks to analyze this growth in inequality and its implications for American democracy. Worldwide examples of economic development are utilized to demonstrate that the forces responsible for the growth in domestic inequality are not particular to the United States, but are operating at the global level, as well.

Arguably, the growth in inequality in contemporary American society only historical equivalents are the 1920s and the period of the Great Depression. The Roaring Twenties witnessed the bull market, the growth and concentration of wealth among the rich, and stagnation and decline among agricultural workers. There are many parallels between the 1920s and now. Specifically, in the 1920s, wealthy Americans were the recipients of tax cuts that resulted in a decline in their marginal income tax rate from 73 percent to 25 percent . Moreover, as a consequence, America’s industrial expansion that was driven by technological innovations, opportunities to realize phenomenal returns on investment motivated Wall Street investors and bankers to engage in highly risky speculative investment activities. Since less than one percent of the American public owned stocks, the returns on investment increasingly concentrated wealth in the hands of the rich and the politically connected. Industrial and agricultural workers were adversely impacted by the collapse of the market in 1929. At this period in American historiography, over 50% of the nations’ population lived in rural areas.

The collapse of the financial market at the end of the Roaring Twenties did not impact American national market alone. Specifically, the financial collapse had devastating consequences on national societies throughout the world, as well. In Europe, banks failed, manufacturing output and trade declined, and the unemployment rates of the industrial workforce increased dramatically. In Germany, the dramatic increase in unemployment coupled with the mounting burden of reparation payments culminated in the rise of the Nationalsozialistische Deutsche Arbeiterpartei— i.e. the Nazi Party—under the leadership of Adolf Hitler. Ultimately, this led to World War II, whose cost when measured in human lives is estimated between 50-70 million. Despite these lessons of the dangers of income inequality and its deleterious impact on societal stability, the current trend in wealth distribution has inaugurated a return to the period of the 1920s when income distribution among Americans was skewed upwards.

Based on the analysis of Emmanuel Saez’s updated version of a 2008 article titled, “Striking It Rich: The Evolution of Top Income in the United States”, the real income growth of the top 1 percent of Americans increased 58 percent versus the bottom 99 percent which was 6.4 percent (see Table 1). During the economic expansion under President Bill Clinton, the growth in real income of the top 1 percent was 98.7 percent versus the rest of Americans, which was 20.3 percent . Under the Bush and Obama’s Administrations, Americans have generally experienced a real decline in their income. However, this declined has impacted the middle and lower classes greater than the top 1% of income earners in the United States. Moreover, the current trends in speculative activities in worldwide financial markets and the sluggish pace of job recovery in the American labor market have contributed to increasing the pace of inequality and concentration of wealth among America’s top earners. Internationally, the growing concentration of wealth is reflected in a 2010 report by a respected international organization.

Table 1: Real Income Growth by Groups, 1993-20101 | ||||

Average Income Real Growth | Top 1% Incomes Real Growth | Bottom 99% Incomes real Growth | Fraction of total growth (or loss) captured by top | |

(1) | (2) | (3) | (4) | |

Full Period 1993-2010 | 13.8% | 58.0% | 6.4% | 52% |

Clinton Expansion 1993-2000 | 31.5% | 98.7% | 20.3% | 45% |

Bush Expansion 2002-2007 | -11.7% | -30.8% | -6.5% | 57% |

Great Recession 2007-2009 | 16.1% | 61.8% | 6.8% | 65% |

Recovery 2009-2010 | -17.4% | 36.3% | -11.6% | 49% |

2.3% | 11.6% | 0.2% | 93% |

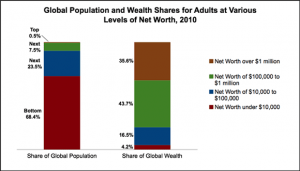

Specifically, according to a study published by the Credit Suisse Research Institute, the top 0.5% of the world’s population controlled over 35% of the world’s wealth while approximately 64% of the world populations share of global wealth is below 5% (see Graph 1). While the bottom 64% of the world earners and a large number of America’s unemployed, previously middle class workers, continue to struggle to find efficacious ways of dealing with changes in their lifestyle precipitated by the 2007 recession, many of America’s corporate giants2 have returned to period of profitability. Citibank3, Bank of America, and other revered American financial institutions have repaid their Troubled Asset Relief Program4 (TARP) loans. AIG and Chrysler posited positive earnings in the second quarter of 2012. In short, while middle class and poor Americans are struggling to find employment, corporate America has managed to restore stability to their economic model for profitability.

One of the main justifications utilized by both the Bush and Obama Administrations for the government bailout of American corporation with TARP funds was that these companies were the nation’s job creators. So far, America’s corporations have largely failed to live up to this expectation. After being the beneficiaries of large tax cuts and government funds that helped them to avoid financial meltdowns, these companies have not reciprocated by increasing the number of Americans on their payrolls.

Indeed, the financial successes of many of these companies have failed to trickle down to the middle and working class Americans. As an April 2012 report by the National Employment Law Project correctly observed:

The decline in wage growth over the course of the Great Recession and its aftermath is easily observed through the year-over-year change in nominal average hourly wages. The rate of change fell dramatically over the course of the recession and the early stages of recovery, and has clearly not yet rebounded; in fact, as of March 2012, hourly wage change was nearly 44 percent below the rate of change as of March 2007, prior to the Great Recession. Not only is wage growth slowing, but the real value of hourly wages – once adjusted for inflation – is also declining when compared to the prior year. From March 2011 through March 2012, real average hourly earnings fell 0.6 percent for all private sector workers and declined by even a great degree – 1.0 percent – for nonsupervisory and production workers.Changes in the number of hours worked per week by both groups did not make up for the loss in wages: an uptick in the hours worked among all private sector employees left their real total weekly wages (a product of the hourly wage and hours worked per week) unchanged, while an increase in hours for production and nonsupervisory workers still resulted in 0.5 percent decline in real total weekly wages.In other words, in real terms workers are earning less now than a year ago.

In an American economy that is driven by consumer spending, declining or stagnating wages is not the correct recipe for economic recovery. However, with the growth of foreign markets in China, India, and Brazil, many American companies such as GE and Boeing are increasingly targeting foreign buyers. Consequently, a growing share of many American companies revenues are being realized in foreign and not the domestic markets. Not surprisingly, weak demand in the domestic labor market is offset by the growing demand for American goods in China, Europe, and Latin American markets. Nevertheless, the slow pace of job growth and the economic windfall in the financial markets have disproportionately favored the rich and have increasingly led to middle and lower class Americans being cut adrift from the American dream.

Explanations for the growth in income inequality have ranged from a secularized version of the Protestant ethics to the negative consequences of deregulation. Advocates of the secularized race neutral version are commonly conservative thinkers whose economic worldview is shaped by Neoliberal thinkers. Neoliberalism is based on the primacy of the market, free enterprise, reduction and/or elimination of government regulations over market transactions, dramatic reduction in state sponsored social welfare spending, and the privatization of government owned companies. Copious elements of the Neoliberal policies can be seen in the recent Ryan Budget that guts funding to welfare and educational programs, but maintain if not increasing spending on the military industrial complex and tax cuts to the wealthy. These Neoliberal policies have become the dominant force shaping American government’s spending priorities since the Reagan Administration. The success of the Clinton expansion and Obama’s Administration attempts to avoid economic Armageddon have done little to change this reality. The full force of these policies was witnessed under the Bush Administration and its pursuit of the Washington Consensus, which largely transformed projected surpluses that were realized by the Clinton expansion into huge budget deficits. These deficits have seriously impeded the federal and state governments’ abilities to implement aggressive stimulus packages that may lead to renewed increases in employment and the reemergence of consumers’ confidence and spending.

Advocates of deregulation are largely constituted by liberals who argue that the collapse of the American financial system can be traced back to the 1980 when President Jimmy Carter signed into law the Depository Institutions Deregulation and Monetary Control Act of 1980. This new law set in motion a process that culminated in 1999 in the systematic dismantling of financial regulations governing U.S. banking and the capital markets. This set the stage for the orgy of financial activities that ultimately fed the phenomenal growth of the financial sector fueled by derivatives and the real-estate bubble that in the end cost the American tax-payers trillions of dollars. While deregulation and the dominance of Neoliberal policies are attractive villains for explaining America’s current malaise, the fact remain deregulation is only the latest regime on which capital accumulation was built. Like all its previous predecessors, it ultimately led to crisis, and crisis is a fundamental if not defining feature of historical capital as a world system.

Contemporary manifestations of crisis and inequality predate the modern capitalist world economy. Specifically, the capitalist world economy as theorized by Terrence K. Hopkins, Immanuel Wallerstein, and Giovanni Arrighi, did not create inequality but reproduced and perpetuated it on a new foundation (Hopkins, 1990; Wallerstein, 1991; Arrighi, 2010). Conceptually and concretely, this new foundation was predicated on profits generated by activities ensconced in a worldwide division of labor, private property, and the growing dominance of the market over the nation-state. Karl Polanyi’s (1957) The Great Transformation anticipated the latter development, which is streamed to us via news reports addressing the daily performance of stocks and bond markets worldwide. It was Polanyi that warns us of the coming dominance of financial markets contra the nation-state. Why should we be surprised by this development over the past forty years5? It has led to a revolution in markets, the emergence of many millionaies and billionaires in Europe, Africa, the Americas, and Asia. The polarization in income inequality, which has been the defining characteristics of emerging nations since the 1970s, is now becoming a reality in the developed nations that are witnessing the fruits of the Thatcher and Reagan Revolutions. Consequently, while we Americans rightly celebrate capitalism and the free enterprise system, it may be difficult to realize that the Thatcher and Reagan Revolutions were congruent with inequality and wealth concentration at the top of the economic pyramid. The concentration of wealth among top earners who conservatives’ literature refers to as job creator is a by-product of the logic of historical capitalism. Historically, this by-product of the unrestricted/unregulated market has been congruent with social and political discords. This was the message of the Occupy movement, which ironically was dismantled by laws framed in the language of equality and freedom for all.

For those of us who truly believe in the principles of freedom and justice for all, particularly the less fortunate, the use of the law to muzzle advocates that are questioning income inequality and the unfettered access of the rich to our political leaders should be a cause for great concern. Indeed, the latter development is truly frightening because the market crash of 1929, the Latin American Debt Crisis of 1982, the Asian Debt crisis of 1997, and the Great Recession 2007-2010 may be prelude to coming social upheavals and the rise of extremist political parties6. The last time that these events culminated in a worldwide depression, it cost over 50 million lives, the Marshall Plan, the Cold War, and the lost of freedom for millions of people who lived behind the Iron Curtin to ultimately tame the forces of fanaticism. Are you ready to pay this price in blood again?

Bibliography

Arrighi, G. (2010). The Long Twentieth Century: Money, Money and the Origins of our Times. New York: Verso.

Fukuyama, F. (2006). The End of History and the Last Man. New York: Free Press.

Harvey, D. (1985). The Geopolitics of Capitalism. In D. Gregory, & J. Urry, Social Relations and Spatial Structures (pp. 365-422). New York: St. Martin’s Press.

Hopkins, T. (1990). Notes on the Concept of Hegemony. Review , 409-411.

NELP. (2012). Slower Wage Growth, Decline Real Wages Undermine Recovery. New York: National Employment Law Project.

Saez, E. (Winter 2008, Revisted March 2012). Striking It Richer: The Evolution of Top Incomes in the United States. Stanford, California: Stanford Center for the Study of Poverty and Inequality.

Steuerle, E., & Pechman, J. (2012, May 16). Historical Highest Marginal Income Tax Rates. Retrieved May 16, 2912, from Tax Policy Center: http://www.taxpolicycenter.org/taxfacts/Content/PDF/toprate_historical.pdf

Wallerstein, I. (1991). Geopolitics and Geoculture: Essays on the Changing World-System. Great Britain: Cambridge University Press.